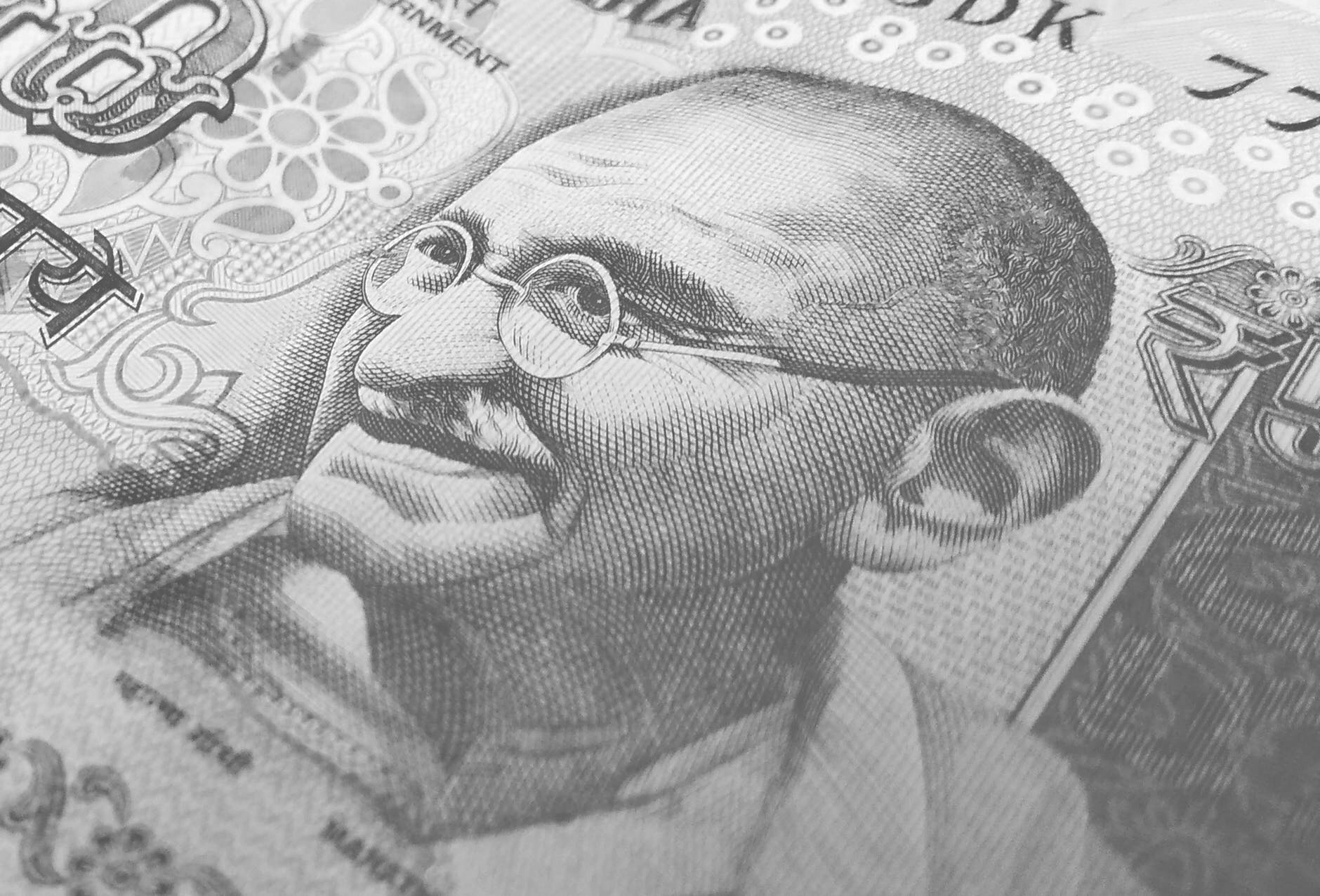

What is wrong with the Indian Financial System?

|

Demonetisation, GST, scams…. does the list end for the financial troubles in India? Are we ever going to see the promised “Ache Din” in the economy of India before the next elections?

One may argue that 2017 was a stellar year for the Indian Economy. A 30% YoY increase on the stock indices, strong GDP numbers, big FII investments into the country- all these factors contributed to an excellent showing for the Indian economy for the year of 2017.

As 2018 kicked in, a slump has entered the markets. Nifty is was below the crucial value of 10000, BSE Sensex fell close to 4000 points in the first 3 months. To make matters worse, every day, a new banking institution comes out with a big financial scam. The biggest of them all, Nirav Modi, who laundered ₹11000 crores (US$ 1.67 trillion) out of the country, has been on the run. Punjab National Ban, which provided the loans to Nirav Modi’s companies, is left with no choice but to do its best to recover the amount (which seems impossible). There have various other scams, latest was which was seen at IDBI Bank.

Further, while on the macro scale, things have seen hunky-dory, on the ground level, things are far from it. After the implementation of Demonetisation and GST, small enterprises have been put out of business by the burden of reduced cash-at-hand. They few that are still running are working on business loans. Business are not receiving payments for services on time, which is affecting the SME market.

Don’t get me wrong here though. I don’t criticize demonetization or GST. In fact, I believe it was great that the government took these actions to curb the black money problem, and prevent businesses from evading taxes. My only concern is that the economy for the small and medium enterprises have not been helped, which is slowly showing up on the macroscopic level.

I just hope that the government takes the necessary steps to allow small businesses to operate without defaulting on payments.